Dramatic increase in lasting power of attorney registrations

According to data from the UK Family Court, the number of Lasting Power of Attorney (LPA) registrations increased dramatically in 2023, eventually surpassing one million for the first time.

The data, which covers the period from October to December 2023, indicates a 37 per cent rise in registrations, which is explained by an ageing population and a quicker online application process.

An individual (the “donor”) may designate one or more persons (referred to as “attorneys”) to make decisions on their behalf in the event that they lose mental capacity or decide they no longer want to make decisions for themselves through the use of a Lasting Power of Attorney (LPA), a legal document that is recognised in the UK.

LPAs come in two primary forms:

- Welfare and Health LPA: this gives the designated attorney(s) the authority to decide on the donor’s daily care, living arrangements and medical treatment, among other aspects of their welfare.

- Property and Financial Affairs LPA: this gives the attorney(s) control over the donor’s assets and money, allowing them to handle tasks like bill payment, bank account management and property sales.

Public Guardian Office

Before being used, the document must to be registered with the Office of the Public Guardian in England and Wales, or the equivalent organisations in Scotland and Northern Ireland. They are essential legal instruments because they let people choose reliable agents to act on their behalf in situations where they are incapable of making decisions for themselves.

Although registering for a lasting power of attorney is made simpler by the streamlined online application procedure, experts have cautioned that the implementation of even a basic LPA can take up to 20 weeks.

Comparing probate to other grants of representation, probate has demonstrated increased efficiency. Probate grants were given out between October and December 2023 in around 14 weeks following the submission of the application; in contrast, letters of administration took about 23 weeks in the case of a will and 17 weeks in the case of none.

Average duration

Even with this advancement, efforts to give older cases priority are evident in the average length of time it takes to issue grants.

In addition, 65 percent of the funds were awarded through digital probate, which took 10.2 weeks from application to submission and 7.9 weeks from document receipt to grant issuance. On the other hand, delays in cases took an average of 23 weeks to resolve, indicating systemic problems.

STEP, a global professional group that includes solicitors, accountants, trustees, and other practitioners who assist families in making future plans, conducted a study in January 2024 in response to concerns regarding probate delays.

Absence of senior experts

According to the study, these delays had resulted in the cancellation of cases for every responder. The main reasons for application delays were found to be registry problems and a shortage of senior personnel for review.

The UK Justice Committee opened an investigation in November 2023 to address probate delays and enhance consumer protection in response to mounting concerns. The goal of the inquiry is to evaluate the support given to executors, beneficiaries and the bereaved during the probate procedure.

The OPG releases upgraded Guidelines for All Court-Appointed Deputies

In a bid to ensure all court-appointed deputies perform their duties to the best of their abilities, The Office of Public Guardian has just published a revamped set of standards, including the new presence of guidance to ‘lay deputies’. Deputies are tasked with making decisions on behalf of individuals who have lost the capacity to make such decisions for themselves.

The role of a court-appointed deputy can be filled by anyone over the age of 18 and is often a close relative or friend of the individual in need. In some cases, the Court of Protection may choose a professional deputy, such as a solicitor, accountant or local authority representative, to fulfil the role.

While standards have long been in place to assist professional and public authority deputies in understanding their responsibilities, The OPG reported that their collected feedback suggested these standards were challenging to use and in need of simplification. Additionally, there was a gap in standards for lay deputies.

With the recent review of these standards, they have been made clearer and applicable to all deputies, including lay deputies. The standards, now focused on eight core areas, reflect the duties and responsibilities of all deputies and available to view now, via the gov.uk website here.

The refreshed standards, while not entirely new, remain guided by the principles of the Mental Capacity Act. The original standards have been re-shaped and included within supporting guidance.

All deputies, professional and lay alike, will now be supervised against these refreshed standards. Deputies are encouraged to use the standards as a checklist to ensure they are considering all relevant areas of their role. If you are a deputy, it is crucial to take the time to understand how these standards apply to you and your role.

PADSN is a free resource to deputyship and appointeeship teams. We provide free training days and advice where possible. You can contact us via email: [email protected] or by telephone: +44(0) 20 7490 4935

Finder’s pledge to offset the Carbon Footprint for each webinar in 2023

The research and data collected into the carbon footprint of our daily online activities and uses of streaming services is significantly lower to that of other carbon emitters. We however, do not regard our online uses as totally environmentally friendly and are looking to change this for 2023.

On behalf of the Public Authority Deputyship Support Network (PADSN), Finders International pledge to offset the estimated carbon emissions for each webinar we host within 2023. To achieve this goal, it required some preparation and research to estimate what the approximate carbon footprint for each webinar is…

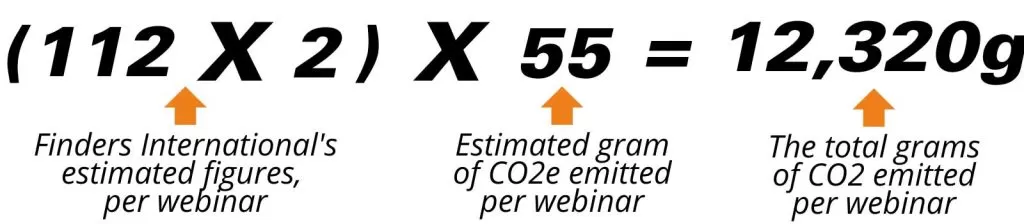

According to the Carbon Trust, at an individual level, the carbon footprint of viewing one hour of video-on-demand streaming is approximately 55gCO2e in Europe. This figure considers the energy use of the different components that are involved in the distribution and viewing of video content: data centres and content delivery networks (used for encoding and storage); internet network transmission; home routers; end-user viewing devices (e.g. TVs, laptops, tablets, smartphones); and TV peripherals (e.g. set-top boxes), where relevant.

Based on our 2021 figures, we average a number of 112 attendees per webinar we host, and our average length of webinar is 2 hours. Considering these figures and those supplied but the Carbon Trust, we have estimated…

Each one of our 2023 webinars is estimated to use 0.12 tonnes of CO2

Trees for Life estimates that 1 tree can offset 0.16 tonnes of carbon per year. Because of this, we will be planting 1 tree for each webinar we host in 2023, not only offsetting our carbon emissions for our online event activities, but increasing our contribution by -0.04 tCO2e per webinar.

Rest assured that viewing our webinars will not add to your carbon footprint and help achieve your individual and firms goal towards becoming ‘Net Carbon Zero’. We will be making all tree planting donations to the National Trust in 2023.

Power of Attorney in house sales

When dealing with finance, the correct Power of Attorney is essential if you are not to run into problems, as a recent Monsey Saving Expert forum thread proves.

The original poster (OP) in the thread complained about their ‘whack-a-mole’ house purchase, where they had difficulties getting an offer accepted, negotiating the price and then arranging the mortgage.

When the problems had been resolved, their solicitor then revealed the seller had a minor paperwork problem. That seller did not have the correct Power of Attorney authorisation to sell the property on behalf of their incapacitated relative, which only came to light five months after the chain had been completed and no-one knows how long it will take to resolve.

Court of Protection

The OP’s solicitor thought it might take up to nine months for the case to go through the Court of Protection unless the seller at the top was able to get an emergency order for the house sale. The solicitor was chasing the seller’s solicitor to find out how far along they process they were. The OP had asked the estate agent for help, as that estate agent was selling both properties, but that person was not acknowledging the emails.

While the OP does not expect the seller’s solicitor or the estate agent to ‘fix’ the situation, they consider it reasonable for both parties to provide information on what is happening and how long it might take.

The OP’s mortgage offer ends at the beginning of January and a new one will cost about £10,000 more, during the fixed period because of the fast rise in interest rates. The OP is living in rental accommodation and again, does not want to end up paying rent indefinitely when they could be building up further equity.

Safeguards in place

The OP expressed surprise that there did not seem to be safeguards to prevent the sale of a vulnerable person’s property if the seller has no legal rights.

David Lockwood, Finders International’s public sector senior business development manager, said: “Unfortunately, this case demonstrates the pitfalls that can befall bystanders when proper processes are not followed. There are many reasons why someone might need to or wish to sell their property—downsizing to a smaller house or flat or to help with the costs of residential care.

“If that person has the mental capacity to deal with the paperwork and admin, all well and good, but if not, what happen then? To sell on another’s behalf, you need the required authority—either Lasting Power of Attorney or becoming a Deputy as appointed by the Court of Protection.”

PADSN is a free resource to deputyship and appointeeship teams. We provide free training days and advice where possible. You can contact us via email: [email protected] or by telephone: +44(0) 20 7490 4935

Call for urgent action over power of attorney delays

This is Money has warned that solicitors are calling for urgent action to deal with the delay in grants of power of attorney, saying that clients are dying while awaiting this vital legal document.

Solicitors have said that it can take up to six months to register applications because of the backlog at the Office for the Public Guardian (OPG). In a letter, they have said that civil servants are making “unacceptable mistakes”, such as returning documents with ripped paperwork or the pages missing.

Previously, it took ten weeks to register for power of attorney, which gives family members or friends the legal authority to make financial or medical decisions on your behalf. However, there is now a backlog of up to 200,000 applications.

Signed letter from solicitors

Solicitors, estate planners and financial advisors signed the letter to the OPG. Katy Kirkland from the BEST Foundation, a non-profit organisation for estate professionals, said that no action had been taken so far to improve the problems.

A spokesperson from the OPG said it had recruited more staff and teams to work around the clock to reduce delays and that the number of lasting power of attorneys registered each month was now back to the pre-pandemic levels.

David Lockwood, Finders International’s senior business development manager, whose area of expertise include deputyship in the public sector, said: “It is crucial that the power of attorney is granted as quickly as possible when dealing with vulnerable people, so that the decisions that are in their best interests can be made. It is deeply concerning that people are dying while applications churn through the system and hopefully action will be taken to remedy this.”

We run a series of events to Public and Private Deputies, see here for upcoming and past events: https://www.publicdeputies.org/events-and-e-conferences/. For more information, contact us on [email protected].

Lasting Power of Attorney – in ‘urgent need of reform’

Research led by the consumer champion, Which? has suggested the Lasting Power of Attorney system is in desperate need of change.

Which’s survey, a questionnaire of 2,000 people UK-wide, showed there is widespread confusion about Lasting Power of Attorney works and that banks often put barriers in the way of people attempting to register as attorneys.

Lasting Power of Attorney (LPA) is a legal document that allows one person to make decisions on behalf of another if that person loses their mental capacity to do so, but it can only be registered while that person still has their mental capacity. Which?’s survey found evidence that many people did not know that registering for an LPA after someone had lost capacity was too late.

Lower understanding among younger people

In the survey, young people and those on lower incomes revealed lower understanding of LPAs than others – 26 percent of people aged 18 to 34 and one in five (20 percent) of those who earn under £21,000 a year said they did not know what power of attorney was, compared to 7 percent of those aged over 55 and one in 10 (10 percent) of those who earn over £56,000.

One in six (16 percent) thought wrongly that an individual loses access to their financial accounts once the legal document is registered. Which? thought this might explain why only one in seven (15 percent) people said they would give someone else power of attorney over their affairs.

Among those questioned who did not have an LPA, 70 percent said they were healthy so they didn’t need one, while 77 percent thought one could be set up at any time – again, an incorrect assumption.

Complexities of the process

Another Which? survey found that the issues reported for more than 8,000 of its members with a registered LPA were a lack of knowledge among staff (60 percent), complexities in the process (38 percent) and delays (28 percent).

Almost a third of people with registered LPAs, 31 percent, said banks were the most difficult to deal with, with claims of lost documents and failures to explain the registration process or require those trying to do so to make unnecessary trips to the bank.

The consumer champion said it heard from people who were asked to register at a bank’s branch even during the pandemic and even where online registration was possible.

Attorney problems

The research has also shown that attorneys experience problems when registering with banks or other financial institutions, with some not authorising full access to a donor’s account even after completing the registration process.

Last year, the Office of the Public Guardian (OPG) launched a consultation on modernising LPAs. The consultation looked at how technology can be used to reform the process of witnessing, improving access, and speeding up the service, as well as widening the OPG's legal powers to check identities and stop or delay any registrations that raise concern.

Which? said the proposals urgently need to be acted upon.

PADSN is a free resource to deputyship and appointeeship teams. We provide free training days and advice where possible. You can contact us via email: [email protected] or by telephone: +44(0) 20 7490 4935

Testamentary freedom – the checks and balances there

Does having a will in place give you testamentary freedom? Not necessarily, Paul Hewitt of Withers LLP writes on mondaq.com.

Testamentary freedom, he notes, is the right to leave your money and assets to whomever you want, and a fundamental principle of English law. However, that sense of control is not always well-founded nor is it necessarily a good thing when there are new developments tempering that freedom.

Hewitt lists the way in which people in England and Wales do not have as much control as they think.

Losing capacity

The most common issue is when someone loses their capacity to make decisions as a result of an accident or serious illness, such as dementia. The Court of Protection can make a statutory will on their behalf, which should be based on the person’s best interests, but it will often not reflect that person’s true wishes and feelings.

It is possible for the Court of Protection can rewrite a person's will while they are still alive. This applies as well to people who have never made a will. Cases are usually anonymised to protect the incapacitated person’s identity. Hewitt quotes one case, Jones v Parkin, where the person had already died — Gladys Peek.

Gladys’ niece and great-niece had helped themselves to cars, jewellery and designer handbags from the money. The Court removed them from control of her money and approved a statutory will. The will listed the beneficiaries as two friends and a charity. As Gladys had never made a will, her niece and great-niece would have inherited the money according to intestacy laws.

Financial provisions claim

Other ways in which a person’s wishes can be overruled after they die include financial provisions claims. A dependent or close relative can claim that more provision should have been made for them. This will often apply in cases where a parent and child have become estranged.

Courts have wide discretion to decide someone has been unreasonable by not leaving anything or too little to their offspring. Hewitt quotes the case of Mrs Illot, who took her mother’s chosen charities to the Court of Appeal because her estranged mother did not leave her anything in her will.

Another financial provision case demonstrates the prevention of injustice. In the case of Bhusate v Patel, Mrs Busate argued against her late husband’s estate as she would have been left with nothing, as his will left everything to the children from his first marriage.

Forfeiture clauses

Making provision for people who have a reasonable hope of inheritance is wise, particularly if one couples this with a forfeiture clause, Hewitt says. A forfeiture clause sets out that the legacy will fail if the beneficiary tries to claim more.

There are also proprietary estoppel claims, which aren’t as common but tend to happen in farming families. Here, a person can argue that the deceased broke their promise to them, and they have relied on that promise to their detriment.

A case in point would be where a son or daughter helps run a farm thinking that they will eventually inherit the land, but instead it is left equally to them and other siblings who might never have shown any interest in the farm.

Provisions overridden

If someone is able to show that there was a promise and they took action because of that promise which was burdensome or otherwise detrimental, the provisions of the will can be overwritten.

Challenges to validity is the main way people obstruct wills, alleging undue influence, a lack of capacity on the part of the testator or even fraud. This often arises in cases where mental incapacity has set in. Professional will writers taking instructions and drafting wills need to take a great deal of care in such cases.

As probate trails are incredibly expensive, compromise will often settle disputes. There’s an element of risk in probate trials because the main witness—the testator—is dead, so protagonists often opt to settle cases out of court.

Jarndyce v Jarndyce

Hewitt warns of the common misconception that the costs will come out of the estate, quoting the case of Jarndyce v Jarndyce in Charles Dickens’ Bleak House novel, which centres on the long and drawn out fictional probate case where in the end the costs of the case consume the whole property.

It is much more common for the loser to pay the winner’s costs, as well as their own, making losing catastrophic. As costs aren’t always recoverable, winning isn’t the be all and end all either. If the deceased has ordered that a favoured child receive everything, that child is well advised to offer the estranged child something.

Those without deep pockets should think very carefully about letting their principles win over commercial analysis of the situation.

The above points, Hewitt notes, are a series of “imperfect checks and balances” that seek to preserve testamentary freedom and mitigate against abuse. Well-drafted wills, he adds, will be difficult to challenge. Testators should brief their adviser properly, explaining their reasoning for promises made or obligations owed, and if no-one with a financial interest is involved in the process of making that will, again this will help it withstand challenges after the testator dies.

Read the full article here. The above is not intended as legal advice and is only provided for informational reasons.

PADSN is a free resource to deputyship and appointeeship teams. We provide free training days and advice where possible. You can contact us via email: [email protected] or by telephone: +44(0) 20 7490 4935

Gifts from an estate when the donor has limited mental capacity

What happens when someone wishes to gift money or other assets to family and friends or good causes, but that person does not have sufficient mental capacity?

Today’s Wills and Probate put that very question to Beverley Beale, a Court of Protection Panel Deputy and associate at Weightmans LLP.

Ms Beale said that most people would be in the habit of making gifts, either on special personal or religious occasions, or to charities, and while there could be tax advantages to doing so, gifting brought benefits to the giver by strengthening connections and making people feel good in themselves.

Attorney powers

Subject to some exemptions, attorneys and deputies are not permitted to make gifts from the donor/protected party’s estate. But the Mental Capacity Act 2005 allows attorneys who are acting under a registered property and finances Lasting Power of Attorney (LPA) to make gifts. The gifts must be ‘reasonable’, taking into account the circumstances of the donor, including the size of their estate, and are permitted:

- On customary occasions to people (including the attorney) who are related to or connected to the donor

- To charities that the donor made or might have been expected to make donations.

Customary occasions under the Mental Capacity Act 2005 are defined as birthdays, marriages or the formation of a civil partnership, or any other occasion where presents are usually given within families or among friends.

Seasonal gifts

For attorneys acting under an Enduring Power of Attorney whether registered or unregistered, measures must be taken to ensure the gift is either seasonal (Christmas presents) or given on the anniversary of a birth, marriage or civil partnership.

The other conditions are that the gift is made to someone (including the attorney) who is related or connected to the donor, or to a charity the donor supported or might have supported. And the gifts should be “of a not unreasonable value”, which considers all the circumstances, particularly the size of the estate.

Most Lasting and Enduring Attorneys need to comply with any restrictions set out in the power of attorney document.

Court of Protection authority

A Financial Deputy has the authority similar to the statutory authority provided to Attorneys. Should a Deputy of Attorney want to make a gift outside of the exceptions they are allowed, they must apply to the Court of Protection for the authority to do so, unless the gifts are minor enough that applying to the Court would be disproportionate. This only applies if a person’s estate is £325,000 or more.

A case in 2018 related to the estate of a woman that was worth £18.5 million. Her attorney (her son) applied for the authority to make a gift to himself of more than £7 million. There was plenty of evidence about the woman’s previous wishes regarding her financial and tax planning, and agreement between the recipients and advisors, and the court agreed the decision was in her best interest.

PADSN is a free resource to deputyship and appointeeship teams. We provide free training days and advice where possible. You can contact us via email: [email protected] or by telephone: +44(0) 20 7490 4935

#FreeBritney – what is conservatorship and what does it mean for the star?

Over the last few years, a lot of attention has focused on Britney Spears and more specifically, the control her father has over her business and personal life.

After a well-documented public breakdown in 2007, the pop star’s father Jamie applied to be conservator of her business and personal affairs as reported on Sky News. A conservatorship is similar to the power of attorney in the UK and is usually applied in cases where people do not have the mental capacity to make decisions regarding their care or money, usually applied if someone has dementia or another mental illness.

In Britney’s case, the conservatorship was split in two – one for her finances and estate and other for her as a person. She has not had control over her finances since 2008. Her father took on the conservatorship for both parts but in 2019, he stepped down from his role as her personal conservator. A care professional was appointed to do this temporarily, although Britney has requested the arrangement be made permanent.

‘Humiliating and embarrassing’

The singer was back in court this week arguing for an end to the conservatorship. In an impassioned speech to an open court, Britney told the judge she found the arrangements “humiliating and embarrassing” and “abusive”. It is not the first time she has spoken in court about the conservatorship, but this is the first time it has been held in public.

Deputyship development days for public sector workers – Finders International organises regular free sessions aimed at those working in deputyship roles to share best practice, learn from Court of Protection officials and more. Read more about our services for the public sector here.

She alleged that at one time she’d been sent to hospital against her will and that her medication had been switched without her knowledge. She also wants to marry her boyfriend, the Iranian actor and model Sam Asghari, and have a baby. The conservatorship will not allow her to do this, and she told the court she has been forced to use birth control against her will to stop her getting pregnant.

Net worth of $59m

Since the conservatorship was put in place, Britney has released three albums, made numerous TV appearances and held a residency in Las Vegas until 2019. According to Business Insider, her net worth in 2018 was about $59 million.

Jamie Spears and his legal team say that the star and her fortune remain vulnerable to fraud and manipulation and that he has saved her from financial ruin.

In 2009, a grassroots movement #FreeBritney started – fans of the star who believe the conservatorship is wrong. Tens of thousands of people have signed petitions asking the White house to intervene. While Britney herself had not spoken in public about the issue before now, fans have claimed she sent coded messages on Instagram hinting at her concerns.

Britney’s court-appointed attorney Samuel Ingham III said Spears had informed him that now she has spoken out in public and made her feelings on the conservatorship clear, she wanted to keep future proceedings private.

He added that he will discuss the issues of formally filing for termination of the conservatorship with the star and the introduction of a private counsel to represent her. Terminating the conservatorship can’t happen until a formal request is lodged with the court.

Council at fault for charging decision

Essex County Council has been found at fault for the way it considered two women’s Disability Related Expenses by the local government and social care ombudsman, Disability Rights reports.

Because of the women’s disabilities, both have court-appointed deputies to make decisions about their financial affairs. The fees charged by the deputy are higher than the rate the council said its own deputyship team would charge to perform the task and because of this, Essex County Council claimed it was unreasonable to treat the higher amount as a Disability Related Expense.

The Care Act in England and Wales means councils should consider the expenses someone incurs that are directly related to their disability when working out how much they contribute to that person’s care.

Council service ‘not reasonably available’

The investigation by the ombudsman said the deputy had been appointed by the Court of Protection, and this did not mean the individuals wanted a more expensive service and that no comparison could be made as the application to the Court was not made by the Council.

The local government and social care ombudsman, Michael King said Essex County Council seemed to be “fettering its discretion” when considering the case of the two women. While the guidance allowed for councils to decide not to allow disability-related expenses where there was a cheaper option, it had not considered the specific circumstance.

The Ombudsman recommended the council reconsider whether the fees are reasonable in relation to the services provided to the two women by the appointed Deputy. Should the council decide to apply on behalf of the two women in question to have Essex appointed as deputy, it must factor the costs of the process into its financial assessment.

The Ombudsman also went on to recommend that Essex County Council consider the policy reasons why a local authority may not be the best alternative to court-appointed deputies.

PADSN is a free resource to deputyship and appointeeship teams. We provide free training days and advice where possible. You can contact us via email: [email protected] or by telephone: +44(0) 20 7490 4935